Minimize Medicare Premium Surcharges

What is IRMMA?

- Income Related Monthly Adjustment Amount

How is IRMMA Calculated?

- MAGI – modified adjusted gross income as reported on your IRS tax return from 2 years ago

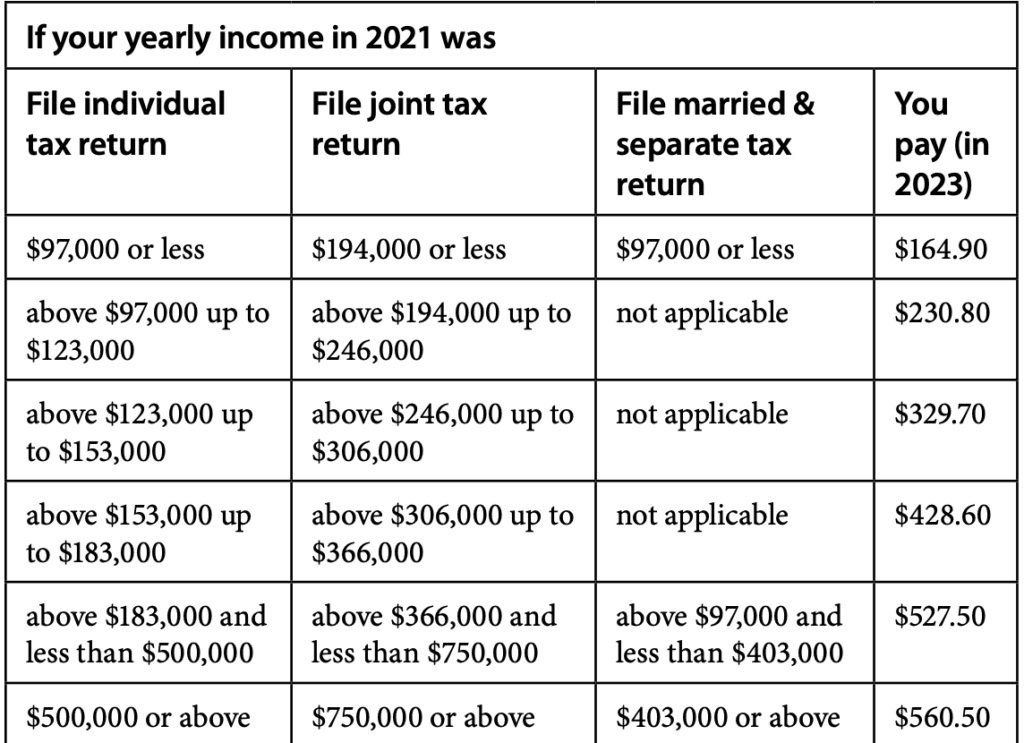

What are income levels and monthly adjustments for 2023?

- If you have questions about your Part B premium, call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

- Note, there is a an additional Part D premium increase due to income – From $12.20 per month up to $76.40

- Many popular tax deductions (charity or mortgage interest) will not help with IRMAA as they do not reduce your MAGI

To minimize Medicare premium surcharges, you can consider the following strategies:

- Understand Medicare premium surcharges: Medicare premium surcharges, also known as income-related monthly adjustment amount (IRMAA), are additional charges applied to Medicare Part B and Part D premiums if your modified adjusted gross income (MAGI) exceeds certain thresholds. The surcharges are based on your tax return from two years prior. Understanding the surcharge tiers and income thresholds will help you plan accordingly.

- Manage your income: Since Medicare surcharges are based on MAGI, you can explore strategies to manage your income to keep it below the surcharge thresholds. Some strategies may include:

- Timing income: If possible, consider deferring income into years where it won’t impact the surcharge calculation.

- Tax deductions: Utilize tax deductions to reduce your MAGI. Consult with a tax professional to identify deductions and credits that can help lower your income.

- Roth IRA conversions: Converting traditional IRA funds to Roth IRAs may increase your income in the year of conversion, but withdrawals from Roth IRAs are not included in MAGI. This can help reduce future surcharges.

- Capital gains: Manage your capital gains by timing the sale of assets or using tax-efficient investment strategies

- Contribute more to your 401K (if you are still working) to lower your MAGI

- Delay taking your Social Security

- Utilize tax-efficient investment strategies: Some investment strategies can generate tax-free income or capital gains, which will not contribute to your MAGI. Consider investing in tax-exempt municipal bonds or utilizing tax-advantaged accounts like Roth IRAs or Health Savings Accounts (HSAs).

- Plan for major life events: Major life events such as retirement, job changes, or the death of a spouse can significantly impact your income and MAGI. Plan for these events and adjust your finances accordingly to minimize surcharges. You can appeal the surcharge if you have a major life event.

- Monitor and review your income regularly: Keep track of your income throughout the year and estimate your MAGI. Stay informed about changes in tax laws and Medicare policies to make informed decisions and take advantage of any available exemptions or deductions.

It’s important to note that these strategies may not be suitable for everyone, and consulting with a financial advisor or tax professional who can provide personalized advice based on your specific situation is recommended. They can help you navigate the complexities of Medicare surcharges and create a plan that aligns with your financial goals.