Tips to prepare for 2023 Medicare Open Enrollment

October 15th is approaching fast. Are you ready for the 2023 Medicare Open Enrollment Season? It is the one time of the year you can make any change to your Medicare. Open Enrollment runs from 10/15/2022 to 12/7/2022, with plan changes effective 1/1/2023. Here are the top five reasons I tell my clients to review their plans.

- Counties with Expanding Medicare Advantage Plans

Each year carriers make changes to the number of plans they offer in each market area. This year there will be significant expansion in South Texas for Medicare Advantage Plans. Counties around San Antonio, such as Kendal, Guadalupe, Hays, and Comal, will see more plans than in 2022. This means more options and benefits than the current offerings. Also, carriers that do not have $0 premiums for PPO plans may begin to offer $0 PPO Plans. Talk to a licensed agent as the coverage will vary by plans.

- Reasons why Carriers expand offers in Markets: There are two major reasons – 1) Population Growth and 2) The current Plans are maxing out with the number of Members. Carriers must make rate and benefit changes at the plan level. What they do for one member in the plan, they must do for all. Creating new plans (or contracts) ensures they can make adjustments.

- Providers that no longer accept your Medicare Advantage planÂ

It is not uncommon for providers to adjust which insurance plans they accept. If your providers no longer accept your Medicare Advantage Plan, there may be other plans that they do accept.

- Reason Providers drop carriers: The main reason is reimbursement rates, or what the carriers pay for the services delivered. Other reasons include Prior Authorization requirements, amount of referrals to specialists, or burdensome claim processes.

- Prescription Drugs that are no longer covered on your Medicare Advantage Plan

Insurance Carriers change which drugs are covered (Formulary) and how they manage step therapy (take a generic version prior to covering the Brand Name). If you are experiencing an increase in out of pocket expenses, due to non-covered prescription drugs, talk to a licensed agent to see if another Plan or Carrier will cover the drug.

- You are paying a deductible for your annual Shingles Shot with your Medicare Advantage Plan

A common complaint I get from Medicare Advantage Members is having to pay a deductible for their annual Shingles shot. This is due to the Shingles Shot being a Tier 3 Brand Name Drug in most Medicare Advantage Plans. Some plans have prescription drug deductibles, starting at Tier 3. There are Medicare Advantage Plans the do not have a prescription drug deductible. Talk to a licensed agent to see if your Market offers these options.

- You are on Original Medicare with a Supplement, but are wondering how much you can save on Medicare Advantage Plan

The benefits of Original Medicare with a Supplement tends to be flexibility (go to any Provider in the U.S. that accepts Medicare) and limited to no out of pocket. As your lifestyle changes and you no longer require access to healthcare in various areas of the country, it may be time to consider Medicare Advantage Plans. You should understand your options – most have low to no monthly premiums, including Prescription Drug Coverage, Dental, Vision, and Hearing benefits.

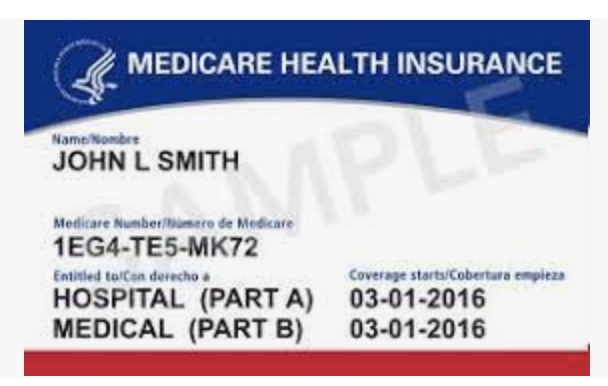

Medicare Advantage Plans 101. When you enroll in a Medicare Advantage Plan, you are no longer receiving your benefits directly from Medicare. Your benefits are provided by a Private Insurance Company through. Most major Health Insurance Carriers offer Medicare Advantage Plans. The carrier is paid a monthly fee, by CMS, to manage your healthcare. The carrier assumes full risk for your claims. As a result, carriers have programs designed to keep you healthy and out of the emergency room. To keep costs in line, they have a network of providers, referrals for Specialists (if you choose a HMO Plan), and certain procedures require a prior authorization. You do get expanded benefits beyond Original Medicare. Prescription Drug coverage is included, as well as, Dental, Vision, Hearing. Other benefits, vary by plan, include fitness memberships, over the counter allotments at pharmacies. Certain plans will even send money each month to Social Security to reduce your monthly Part B premium. If you have Chronic Conditions, such as, Diabetes or Heart Conditions you may qualify for additional benefits with a Chronic Special Needs Medicare Advantage Plan.

Knowledge is Power During this Years Medicare Open Enrollment!

As a licensed Medicare agent, 95% of my job is to educate Medicare Eligible people. Everyone’s situation is different, but a quick conversation, or coffee meeting, can ensure you know your options. If you are in the right plan, we will let you know. See www.mccdelivers.com for more details on Medicare. Have questions? Schedule a consultation here https://calendly.com/mccdelivers/schedule-consultation.

Want more information on Medicare – https://mccdelivers.com/medicare/